In the world of personal finance, unlocking true wealth often starts with two powerful forces: a growth mindset for investing success and calculated leverage strategies that turn debt into a tool for growth. Many aspiring investors shy away from these concepts, fearing losses or the complexity of borrowing. But what if you could reframe debt not as a burden, but as a bridge to financial freedom? In this guide, we’ll explore how to harness financial leverage in investing, distinguish good debt vs. bad debt examples, and build a resilient approach to wealth building. Whether you’re a beginner dipping your toes into leveraged investing for beginners or a seasoned pro refining your portfolio, these insights can help you make more informed decisions and accelerate your financial journey.

Drawing from timeless principles like those in Think and Grow Rich, we’ll break down how mindset shifts can eliminate fear, how smart borrowing creates positive cash flow, and why long-term vision trumps short-term fluctuations. Ready to transform your approach? Let’s dive in.

Book Your Strategy CallCultivating a Growth Mindset for Investing Success

At the heart of every successful investor lies a growth mindset in investing—the belief that abilities and intelligence can be developed through dedication and learning. This isn’t just motivational fluff; it’s a proven psychological edge that separates those who thrive from those who stall.

Consider the common pitfalls: Many people approach investing with a fixed mindset, fixating on potential downsides like market dips in GICs or mutual funds. “What if my money goes down?” they worry, opting for the safety of low-yield savings instead. But this fear-based thinking mirrors everyday hesitations—skipping a job interview due to rejection anxiety or avoiding networking because “I’m not good at small talk.” The result? Missed opportunities for growth in relationships, careers, and finances alike.

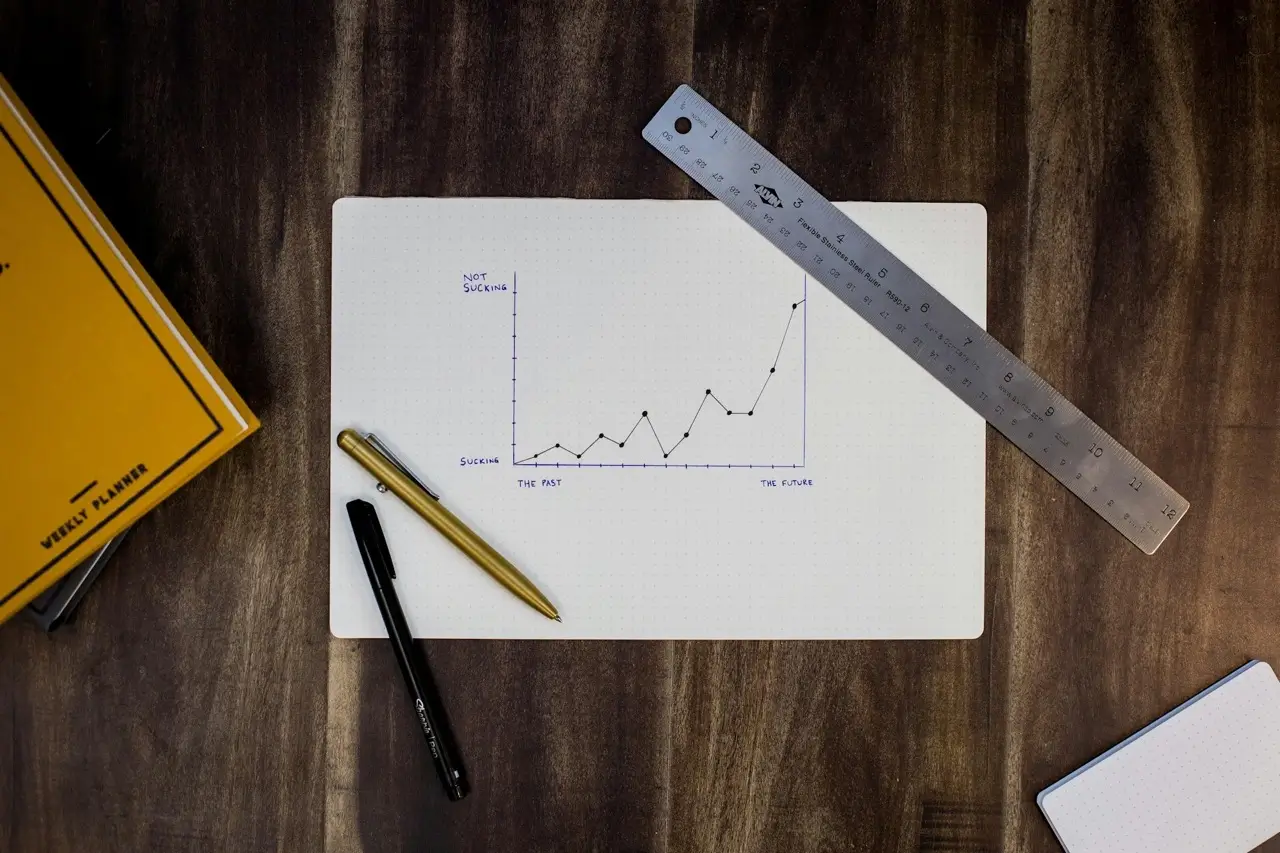

A growth mindset, on the other hand, embraces challenges as learning opportunities. It’s about asking, “What can I gain from this experience?” rather than “What if I fail?” In investing, this means viewing market volatility as a rollercoaster—not a reason to bail. Instead of obsessing over daily swings, zoom out to monthly, yearly, or multi-year trends. Tools like historical performance charts reveal that over time, well-chosen investments trend upward, weathering recessions and recoveries.

Psychologists like Carol Dweck highlight how this mindset fosters resilience. Investors with a growth orientation continuously educate themselves, adapting to trends like sustainable investing or digital assets. They don’t “win” every trade, but they learn from losses, iterate, and compound their knowledge. The payoff? Greater happiness, health, and financial strength. As one timeless principle puts it: The universe responds to what you vividly imagine and believe you’ve already achieved. Visualize your portfolio growing, and take inspired action—your results will follow.

Incorporating a growth mindset isn’t overnight magic. Start small: Journal one lesson from a recent financial decision, or read a chapter from an empowering book weekly. Over time, this mental leverage amplifies every other strategy we’ll discuss.

What is Calculated Leverage? A Beginner’s Guide to Smart Financial Leverage

Leverage isn’t just a finance buzzword—it’s a multiplier for results, applicable far beyond spreadsheets. At its core, calculated leverage means using resources (time, money, or effort) strategically to achieve outsized outcomes, always with analysis upfront to minimize risks.

Think everyday: Negotiating a back massage in exchange for mowing the lawn? That’s leverage—exchanging effort for a desired return. Scaling this to finances, leverage lets you amplify returns without proportionally increasing your input. But here’s the key difference from “regular leverage”: Calculation. Blind borrowing, like maxing a credit card for impulse buys, invites disaster. Calculated leverage involves crunching numbers on returns, costs, and risks first.

In financial leverage strategies, this often means borrowing at low rates to invest in higher-yield assets. For instance, tapping home equity at modest interest to fund income-generating opportunities. The goal? Positive arbitrage—where your investment outpaces borrowing costs. This isn’t about going into debt recklessly; it’s about intentional moves that align with your goals.

Why does it work? Leverage frees up your capital for multiple plays, creating a snowball effect. A single well-leveraged investment can fund the next, building wealth exponentially. But success demands discipline: Vet opportunities, stress-test scenarios, and consult pros like accountants to ensure compliance with tax rules. When done right, calculated leverage isn’t gambling—it’s engineered growth.

Good Debt vs. Bad Debt: Key Examples and Strategies

One of the most liberating shifts in personal finance is redefining debt. We’ve all heard the mantra: “Debt is bad—pay it off fast.” While eliminating high-interest burdens is wise, not all debt is the enemy. Enter good debt vs. bad debt: The former builds wealth; the latter erodes it.

Bad debt drains resources without creating value. Classic examples include financing a luxury car with $500 monthly payments that depreciate faster than you drive. It’s a liability sucking cash from your pocket, leaving you paycheck-to-paycheck. Consumer debt like this—credit cards for vacations or gadgets—rarely appreciates and often carries steep interest.

Good debt, conversely, is an investment in your future. It generates income or equity exceeding its cost. Take a mortgage on a rental property: If it cash-flows positively (rent covers payments plus profit), it’s good debt. Suddenly, that $500 monthly car payment? Offset it with rental income, turning a liability into a neutral or positive play. No out-of-pocket hit, and you’re building equity.

Other good debt examples include student loans for high-earning careers or business loans expanding revenue streams. Even dividend stocks bought on margin can qualify if yields beat borrowing rates. The strategy? Always ask: “Does this asset produce more than it costs?” In Canada, where national debt concerns dominate headlines, individuals mimicking corporate smart debt—productive borrowing—can sidestep pitfalls.

To implement: Audit your debts. Refinance bad ones aggressively, but deploy good debt surgically. Tools like cash flow projections ensure sustainability. Remember, the aim isn’t more debt—it’s smarter use of it for wealth building through smart debt.

Leveraging Real Estate and Other Assets for Income

Real estate shines in leveraged investing for beginners due to its tangible cash flow potential. Borrow against existing equity to acquire a property yielding steady rents, creating a self-funding machine. In our earlier car example, that $500 inflow neutralizes the expense, freeing mental space for bigger goals.

But diversification rules: Beyond bricks and mortar, explore dividend aristocrats or index funds. These passive vehicles offer liquidity and broad exposure, ideal for novices. The beauty? Many qualify for leverage via lines of credit, blending accessibility with upside.

Pro tip: Join investor networks for mini-courses on niches like fix-and-flips or syndications. These communities demystify tactics, sharing case studies that turn theory into action.

The Power of Tax-Advantaged Borrowing

Calculated leverage gets turbocharged with tax perks. In Canada, interest on borrowed funds used for investments—like pulling equity for stocks or properties—is often deductible. Consult your accountant to confirm eligibility, but this write-off effectively lowers your borrowing cost.

Picture this: Secure funds at 2.5% interest, deduct it for a net rate under 2%, then invest in assets averaging 10-15%+ annually. The spread? Pure profit. Pair with long-term holds to maximize compounding, turning modest sums into substantial nests.

Navigating Market Volatility with Long-Term Vision

Markets aren’t linear—they dip during tech busts or pandemics, testing even the steeliest nerves. But growth mindset investing equips you to ride it out. Ignore daily noise; focus on historical trajectories showing upward arcs post-downturns.

Charts like the ANDEX illustrate this: Over decades, diversified indices outperform 90% of active managers. One powerhouse example? Broad market trackers delivering average annual returns north of 10% long-term, far eclipsing safe havens like GICs that benefit banks more than you.

The lesson: Stay invested. Pullouts during lows lock in losses; patience unlocks gains. Banks push “safe” options to lend your money—choose vehicles prioritizing your growth instead.

Putting It All Together: Steps to Start Your Journey

Ready to act?

- Assess Mindset: Reflect on fears; commit to one growth habit weekly.

- Audit Debt: Categorize good vs. bad; plan offsets for liabilities.

- Calculate Leverage: Model scenarios—borrowing cost vs. expected returns.

- Diversify Wisely: Blend real estate, equities, and passives.

- Seek Expertise: Network in investor groups for tailored insights.

By weaving these threads, you’ll craft a portfolio resilient to shocks and primed for prosperity.

In closing, embracing calculated leverage and a growth mindset isn’t about perfection—it’s about progress. For deeper dives into investor financing and strategies, explore resources at LendCity.ca, where expert guidance awaits to fuel your next move. What’s one step you’ll take today? Your wealth-building adventure starts now.

Book Your Strategy CallFrequently Asked Questions

A growth mindset in investing is the belief that your investing abilities and financial intelligence can be developed through learning and experience. Unlike a fixed mindset that focuses on potential losses, a growth mindset helps investors view market volatility as a learning opportunity, leading to better long-term wealth building and more informed investment decisions.

Bad debt drains your resources without creating value, like high-interest credit cards or depreciating car loans. Good debt generates income or equity exceeding its cost, such as mortgages on cash-flowing rental properties, business loans that expand revenue, or student loans for high-earning careers. The key question is: u0022Does this asset produce more than it costs?u0022

Calculated leverage involves borrowing at low interest rates to invest in higher-yield assets, creating positive arbitrage. For example, you might tap home equity at 2.5% interest to purchase a rental property generating 10-15% annual returns. The difference between your borrowing cost and investment returns creates wealth, especially when paired with tax-deductible investment interest in Canada.

Yes, when done strategically. Beginners should start by calculating potential returns versus borrowing costs, stress-testing scenarios, and consulting financial professionals. Focus on income-generating assets like dividend stocks or rental properties where cash flow covers debt payments. Diversification and long-term vision are essential to navigate market volatility safely.

In Canada, interest on borrowed funds used for investments (like pulling home equity to buy stocks or rental properties) is often tax-deductible. This effectively lowers your borrowing cost—for example, a 2.5% loan might cost under 2% after deductions. Consult with an accountant to confirm eligibility and maximize this powerful wealth-building tool.

You can offset bad debt by creating income-generating assets that cover the debt payments. For instance, if you have a $500 monthly car payment (bad debt), acquiring a rental property that generates $500+ in positive cash flow neutralizes that expense. This transforms your financial position from negative to neutral or positive while building equity.