Mortgage & Financing

Understanding mortgages, rates, approvals, and lending strategies for real estate investors.

1

Strategy Call

Discuss your goals and financing needs

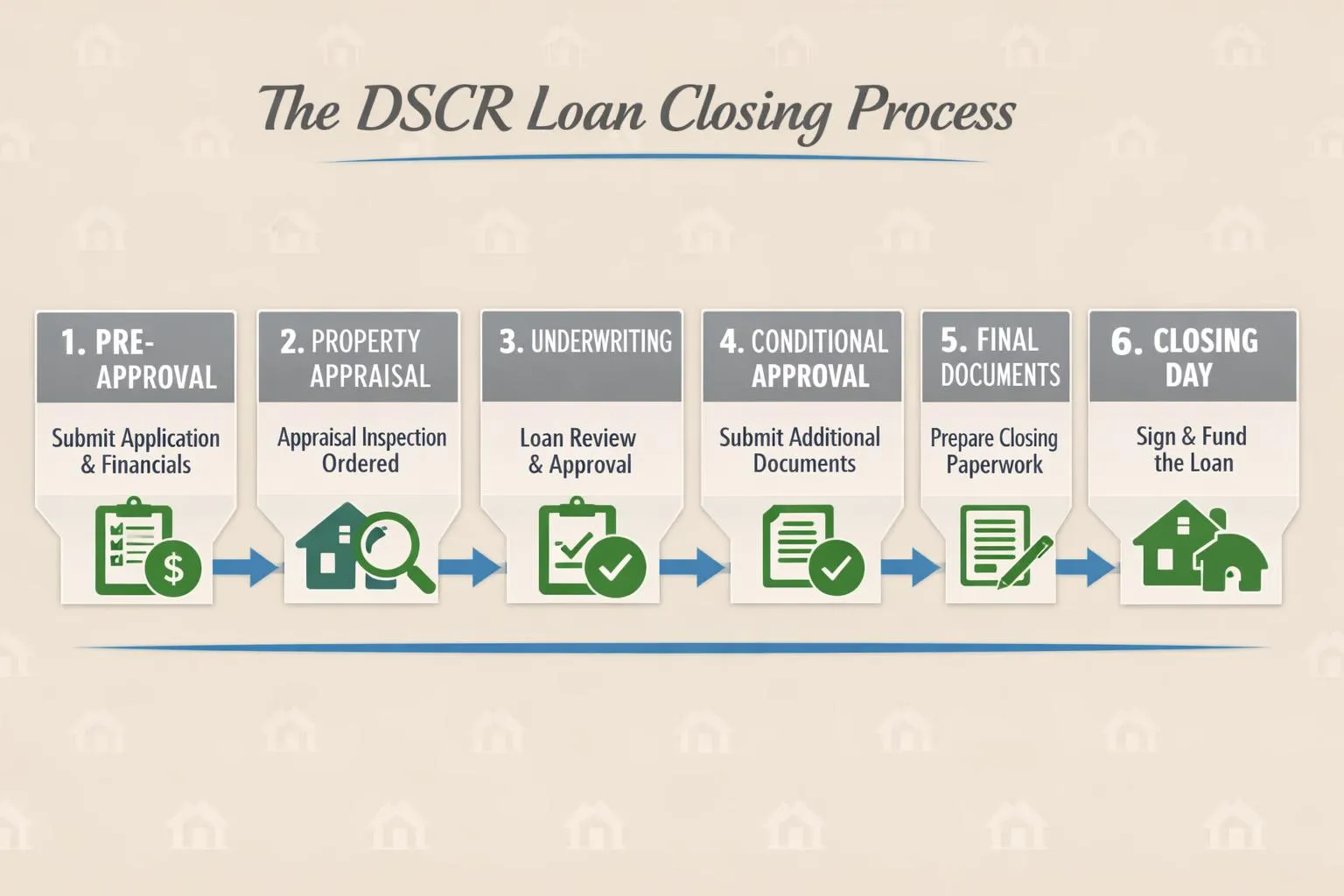

2

Get Pre-Approved

We match you with the right lender

3

Close Your Deal

Fast closings with expert support