US & Cross-Border Investing

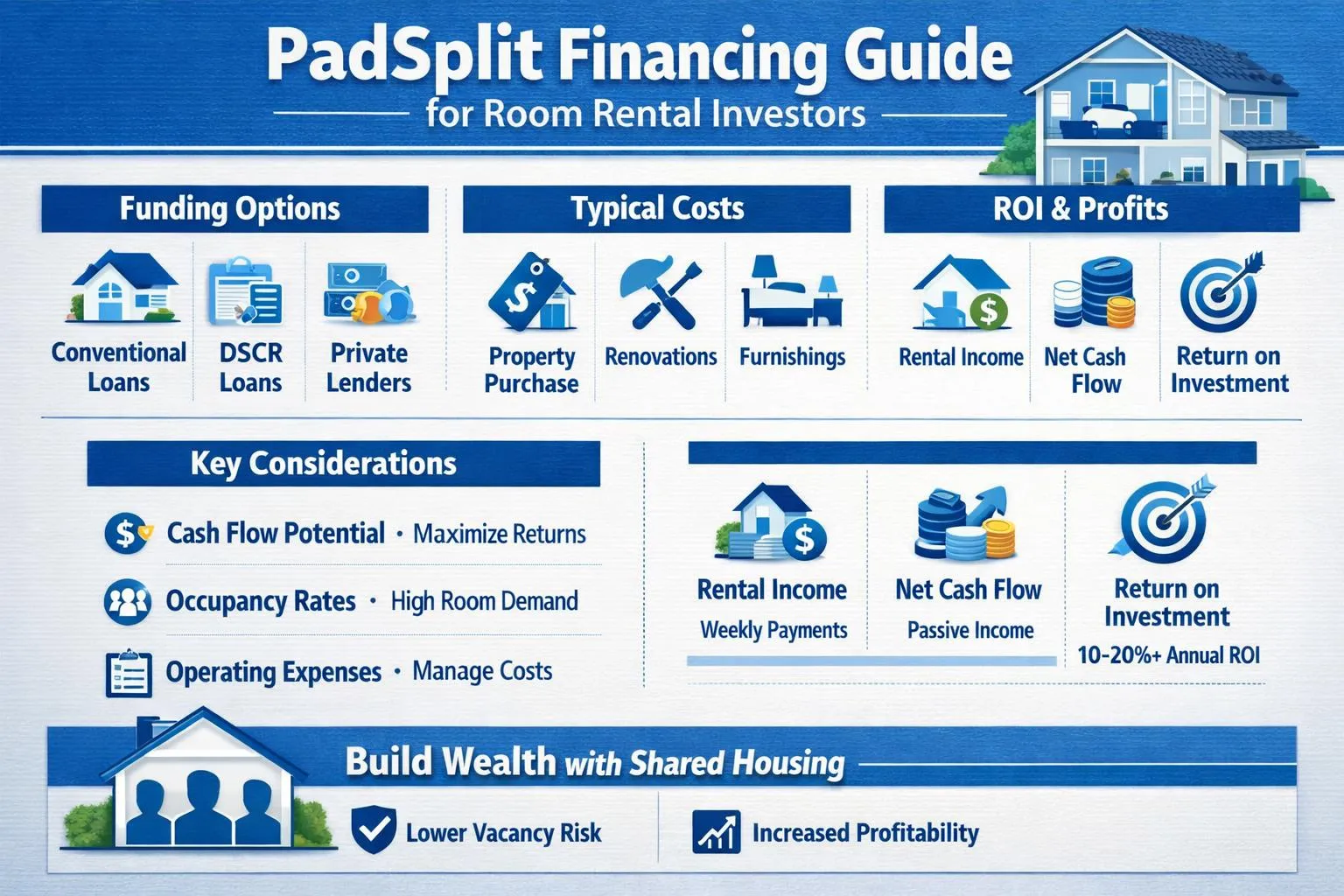

Investing in US real estate as a Canadian - DSCR loans, cross-border strategies, and market insights.

1

Strategy Call

Discuss your goals and financing needs

2

Get Pre-Approved

We match you with the right lender

3

Close Your Deal

Fast closings with expert support